Session Date: 8th October, 2020

Session Time: 05:15 PM to 06:45 PM (IST)

Session Partner

In Partnership

Panel Members

Perspectives

01. Non lending fintech solutions in insurance, savings and wealth management: How is the market evolving?

02. Is it challenging for entrepreneurs to change the traditional behavioural pattern of lending and borrowing in the minds of end-beneficiaries?

03. What are the key challenges to scalability from a legal and policy perspective?

04. How has covid-19 impacted the overall growth of this sector?

FACTS & FIGURES

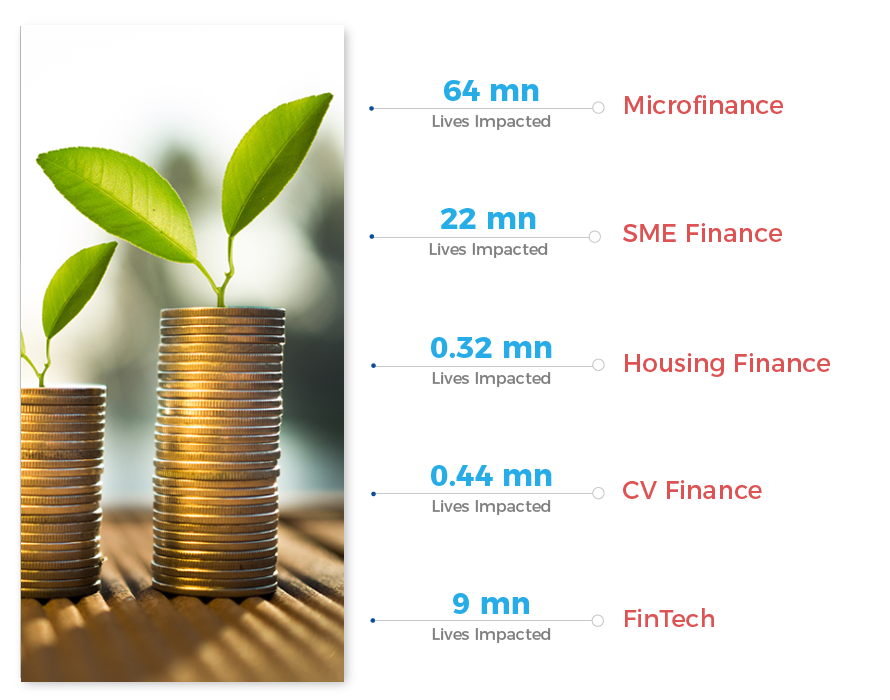

Impact Investments into Financial Services have grown at 19% CAGR and account for 50% of total capital deployed in impact investing over the last decade. This sector is gradually shifting its focus from traditional lending models with larger proportion of newer investments. 156 social enterprises have impacted over 96 million people in the ten-year period.

KEY IMPACT IMPERATIVES

Enhance financial access to other financial solutions like savings, insurance

Reduce dependency on a single product – ‘credit’

Find custom solutions to various financial challenges of people