Session Date: 7th October, 2020

Session Time: 05:15 PM to 06:45 PM (IST)

Session Partner

In Partnership

Panel Members

Perspectives

01. Covid-19: What are the implications for the target underserved segments?

02. What are the funding models for an informal economy?

03. How has diversification from microfinance to other lending models like – education finance, agriculture finance, etc. changed the demography of the sector?

04. Has transitioning on tech platforms from a physical set up made scalability more feasible?

FACTS & FIGURES

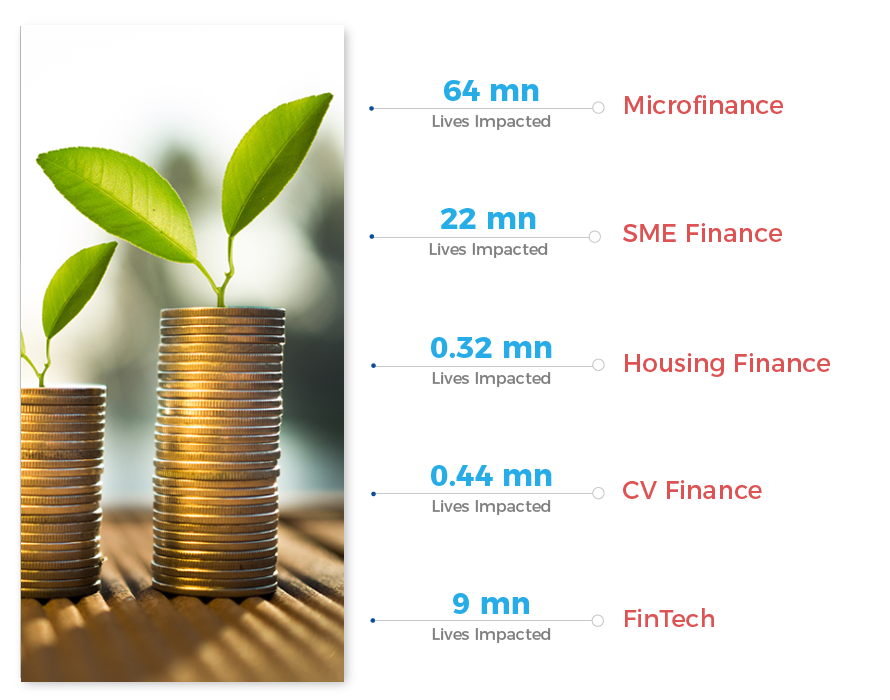

Impact Investments into Financial Services have grown at 19% CAGR and account for 50% of total capital deployed in impact investing over the last decade. This sector is gradually shifting its focus from traditional lending models with larger proportion of newer investments. 156 social enterprises have impacted over 96 million people in the ten-year period.

KEY IMPACT IMPERATIVES

Enhance access in financially excluded regions

Improve credit delivery to those with no credit history

Enhance underwriting and funding to those with weak financial documentation