Session Date: 5th October, 2020

Session Time: 06:45 PM to 08:00 PM (IST)

In Partnership

Panel Members

Perspective

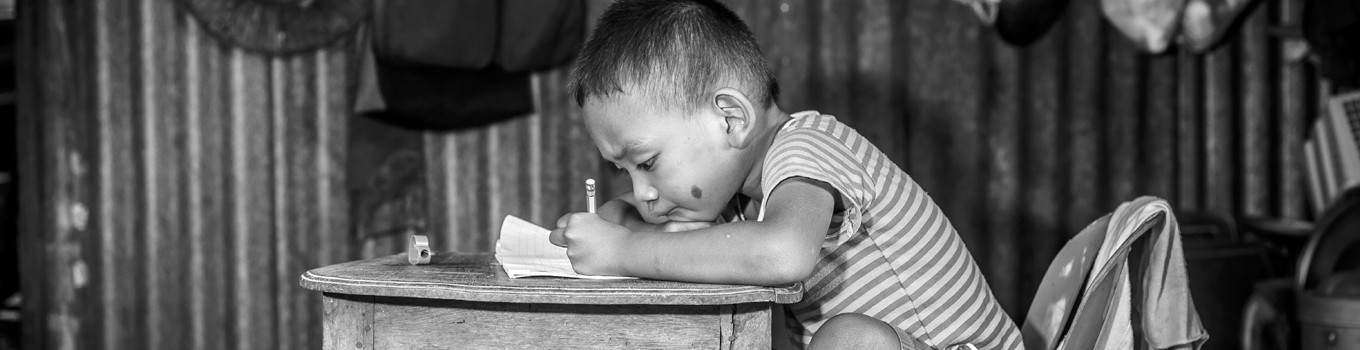

A large base of low- income customers, strong technology culture, a vibrant entrepreneurial ecosystem with a strong resolve to use affordable yet innovative solutions at scale – This perfect mix has made India the impact lab of the world- an attractive destination for impact capital. This should not change due to the Covid-19 hiccup.

Retrospective

According to a IIC and Asha Impact report, The India Impact Investing Story (2020), the Indian impact investments have observed a steady growth in the past decade (CAGR of 25%). India is home to over 550 impact enterprises across a variety of priority sectors- Agriculture, Education, Healthcare, Financial services Technology, Water and Waste Management, Livelihoods, Clean Energy Access and has impacted over 500 million lives of people in the low and middle income group. Key insights from the report:

- Every dollar of impact funding has been able to crowd in 1.9 dollars of commercial capital.

- India has a long track record in the impact space, with rapid growth over the past ten years – In October 2010 the industry faced a severe test with the microfinance crisis, but since then it has grown 8x in terms of annual deployment ($2.6 billion in 2019 and a cumulative outlay of $10.5 Billion YTD)

- Indian impact traditionally invested into financial services but has successfully diversified into other sectors like health care, education and agriculture. FS which accounted for 77% of investments in 2010 is down to 43% in 2019.

Covid-19 – A Threat?

Out of over 150 million low income beneficiaries served by the impact enterprises, impact investors estimate that up to 75 million beneficiaries have lost their livelihoods and fallen back into poverty due to the extended lockdown enforced during the Pandemic. Investors expect that between 30-35% of the 200 million customers being serviced by the impact enterprises could potentially slip back into poverty given the size and scale of the disruption. An overall cash flow shortfall to the extent of 20-25% of income across enterprises is estimated. (IIC Survey, 2020)

Key Questions to be addressed in the panel discussion

01

Unique nuances of investing in India : the great, the good and what needs to get better?

02

Diversification away from Financial services: how do we see that trend playing out in the future?

03

India’s position in the global impact investing world: Can India’s soft power of frugal innovation make it a market leader?

04

What will it take to scale innovative impact business solutions in India?

05

Building capacity and resilience in the Industry: What can we learn from the Covid-19 pandemic?